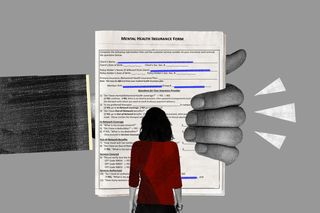

We Asked Experts Why It Is So Hard to Get Insurance Coverage for Mental Health in India

“I think it’ll take a few years before there’s widespread insurance coverage for mental health, as well as awareness about it.”

India’s Mental Healthcare Act, 2017 states that “every insurer shall make provision for medical insurance for treatment of mental illness on the same basis as is available for [the] treatment of physical illness.” In furtherance of the statute, in August 2018, the Insurance Regulatory and Development Authority of India (IRDAI) had directed insurance companies to comply with the statute and make provisions for the coverage of mental healthcare under their respective insurance policies.

However, in response to an RTI in February 2019, the IRDAI acknowledged that none of the insurance companies had complied with the law thus far. Subsequently, the Supreme Court had issued a notice to the IRDAI in June 2020, seeking an explanation for the failure of insurance companies in India to provide coverage to mental healthcare. In April this year, the Delhi High Court again directed the IRDAI to ensure coverage for mental healthcare — stating that it was “clearly getting the feeling” that IRDAI was not taking any action against insurance companies for non-compliance of the law, and was only taking steps when directed to do so by courts.

To understand the inordinate delays in the implementation of the law, and how it could alter the landscape of mental healthcare in India, The Swaddle’s Devrupa Rakshit spoke to Sayali Mahashur, Tanya Fernandes, and Amiti Varma, who are research associates at the Centre for Mental Health Law and Policy (CMHLP), Pune. As part of the India Mental Health Observatory set up by the CMHLP last year, they have been involved in the comprehensive analysis of health insurance policies launched in 2019 and 2020 to check if insurance companies are complying with the law.

The Swaddle: The IRDAI had issued a circular in August 2018 asking insurance companies to provide medical insurance for mental healthcare. Four years have passed since — what do you think may have prevented its implementation so far?

Sayali Mahashur: For insurance policies, an actuary analyzes mortality rates and population health statistics, based on which, they calculate a premium amount that can benefit the policy-holders who claim their insurance — besides helping the insurance companies make a profit too. When a new condition is included within the same premium amount, the addressable claim goes up — disrupting the ratio between them, and creating a tricky situation that companies have not yet figured how to navigate.

However, as citizens, this isn’t really our concern. It’s between the insurance companies and the government to figure a way out. When a new legislation is created, it is, of course, the duty of the companies to abide by its provisions. And there’s a regulator [IRDAI] to ensure that they do that.

Tanya Fernandes: But we have seen some progress. Before the 2018 circular was issued, mental illness was a standard exclusionary clause across insurance policies. However, when we mapped revisions in insurance policies after 2018, we noticed mental illness has been removed as an exclusionary clause, which is a significant development.

SM: In fact, the Delhi High Court has clearly stated now that even if an insurance policy states that mental healthcare is excluded from coverage, that clause wouldn’t be considered valid since it goes against the law.

TS: Realistically, by when do you think can we expect insurance coverage for mental healthcare?

SM: It’s very difficult for me to pinpoint a specific timeline, but it seems like the tussle will go on for a while. There will be people who will face difficulties, some of them will probably have the patience and the energy to contest them in courts, and judgments will keep pushing the regulator [IRDAI] to become stronger… However, insurance companies have started taking the law on coverage for mental health relatively more seriously now — for instance, some of them are working towards having mental health professionals on their panels. But I think it’ll take a few years before there’s widespread insurance coverage for mental health, as well as awareness about it. But it’s not going to be an easy process till then.

TS: Which parts of mental healthcare will be covered by medical insurance once insurance companies begin complying with the Mental Healthcare Act?

TF: Basically, the new statute says that mental illness coverage will be at par with physical illness coverage. Right now in most of the policies, coverage for the latter includes only inpatient hospitalization, pre-and post-hospitalization costs, and certain other services — like, the ambulatory service. But most mental health conditions require treatments like therapy and other counseling, which are not automatically covered under health insurance policies by virtue of the law. They will be covered only if the insurance policy explicitly includes coverage for such services, which very few health insurance policies do.

SM: The ones that cover OPD [or, outpatient department] are very restrictive — for instance, they may cover only up to five to 10 visits annually. For a person seeking therapy for depression, anxiety, or any other mental health condition, that’s not enough — they may need to go in for consultations many more times than that. And these sessions are expensive too. So even when things do get better for insurance coverage of mental healthcare, policies will mostly cover only hospitalization.

Having said that, some insurance companies have expressed an intention to cover OPD costs for mental healthcare, but we haven’t seen anything groundbreaking being implemented there yet.

TS: Do citizens need to buy fresh insurance policies to avail of insurance coverage for mental healthcare, or will previously existing medical insurance policies they have been paying premiums for, include mental healthcare?

SM: Existing policies are supposed to cover mental healthcare automatically now, irrespective of whether or not the policy documents explicitly include it. Whatever coverage one has for physical illnesses will extend to mental illnesses as well. The only exception to that would be if someone has purchased a policy for specific health conditions — like vector-borne diseases, in which case, mental illnesses will not be covered under the same policy, of course. Similarly, critical disease policies also apply only to specific diseases listed within the policy document — they state that pretty clearly. It’s the same for travel accident policies too. Other than these, general health policies — both existing ones and new ones — are supposed to cover mental healthcare by default now.

TS: How are insurance companies planning to ensure mental healthcare is accessible and private?

TF: There is nothing in the law that says insurance companies need to be sensitive while processing claims related to mental health insurance. Generally, there’s a series of steps that need to be followed for every individual either claiming their insurance, or purchasing an insurance policy. One needs to answer different questionnaires about one’s condition, show certificates from the professionals treating them, etc. This process isn’t very transparent in our country, so we have not been able to assess whether it’s any different for mental illnesses — in terms of privacy or sensitivity — than it is for regular healthcare.

Amiti Varma: In terms of insurance providers, even what’s written on paper doesn’t easily translate to real life — the experience on-ground has been very difficult for people, who have had to approach courts and grievance cells of the IRDAI even for enforcement of provisions clearly listed out in the legislation. In terms of sensitivity, I think the basic thing insurance providers really need to do is to ensure that seeking insurance for mental health isn’t such a struggle every time. It shouldn’t have to be — it’s not a fight, it’s a right.

This interview has been edited for clarity and length.

Devrupa Rakshit is an Associate Editor at The Swaddle. She is a lawyer by education, a poet by accident, a painter by shaukh, and autistic by birth. You can find her on Instagram @devruparakshit.

Related

Scientists Simulated a Roller Coaster Ride to Understand What Causes Migraine