The Crypto Crash Shows How Hype Fuels Dangerous Trends

A combination of the hype business model and the internet birthed crypto — and led to its downfall when the hype bubble burst.

In the last two weeks, cryptocurrency has had to face an existential reckoning. Various currencies have crashed in the last 24 hours alone; crypto giants like Bitcoin, Ethereum, Solana, to even Doge (intended in the first place as a joke currency) plummeted in value. “As fear and interest rates spike, investors are selling off their positions and billions of dollars of value are being erased from the industry,” The Atlantic noted.

The whole saga has to do with the shaky foundation of “value” itself that crypto is based on; powerful people’s words about the market have an outsize effect on the market itself. This, in turn, is what hype is all about — and why it is so dangerous. The crypto crash is a combination of the hype business model both propagated by the internet that echoes privileged narratives and big media that refuses to critique these claims — which has led to its downfall when the hype bubble burst. It’s happened many times before — but this may just be the beginning of the end.

We must start at the beginning, tracing the root of the phenomenon to a business model that some have called “hype” — and it originated in streetwear. Essentially, hype defines “cool” — it makes or breaks a sale because it is the final authority on the “it” factor. Supreme was one of the first brands to appropriate streetwear into high-end retail, creating the “hype beast” — a person obsessed with acquiring the best, most “in” things they can get their hands on. Hype beasts are covered head to toe in hype-generating brands, often signifiers of wealth and luxury. Hype beasts are also, notably, overwhelmingly men.

Hype culture is all about the chatter more than the products themselves. Often, it doesn’t even matter what the actual objects are as long as they’re hyped up. Hype combined with the Internet, then, make for an even deadlier business model, propelling the likes of Shein to epic global proportions. Hypebeasts peddling a lifestyle based on the power of signaling alone thus evolved into the Internet upgrade of the hypebeast: the crypto bros.

Related on The Swaddle:

Blockchain Ideology Is Rooted in Exclusion. A Feminist Lens Shows Why

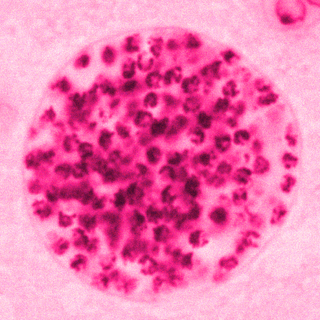

Courier cites “drops,” irony, scarcity, high prices, and community as some of the ingredients of the hype business model. The rise of non-fungible tokens (NFTs) in 2020 checked all these boxes and more; they’re irony-poisoned Internet spawns that look like bored apes and are somehow valued by millions. There is a bored ape yacht club community of fellow ironic purveyors of strange blockchain bazaars.

“… understanding how Nyan Cat can sell for $600,000 is important because once you do that, a lot of other things start making sense, from GameStop to Dogecoin to the hypebeasts that have for years lined up around the block to buy $200 t-shirts at Supreme,” wrote finance journalist Felix Salmon.

We’ve had clues of what was to come early on. “The products are devious and always push things to the extreme… The future of the web is going to thrive on hype,” Raihan Anwar, who co-founded token-driven social network Friends With Benefits, told Courier.

The thing about hype is that it fades. And when crypto, NFT, and other blockchain applications are propelled into fame and widespread use purely based on hype, they are bound to be unstable financial entities. The story of Dogecoin itself is telling in terms of hype can create monstrous apparitions of wealth out of nothing. Its co-creator, Jackson Palmer, said he created it as a joke and recently spoke about how the crypto industry is a cult that uses “shady business connections, bought influencers and pay-for-play media outlets” — in other words, to build hype.

Related on The Swaddle:

How Crypto ‘Bro’ Culture Around Finance Is the New Toxic Masculinity

“The opinions held by certain very powerful people still determine the future of crypto,” Shreya Mukta, a researcher at the intersection of tech, gender, and design, told The Swaddle earlier. She was talking about the way Elon Musk’s opinions about crypto drive market fluctuations — and a similar thing is happening right now.

In order to sustain the hype, it is also important to negate any criticism. “An important aspect of any ideology is the way it emphasizes some dangers and downplays others. True bitcoiners emphasize the problems with government corruption. But they downplay the financial risks of crypto,” writes cybersecurity researcher Rick Walsh.

This has consequences for people who buy into the hype without having the means to do so. Even more harmful is the fact that the wealthiest of people in tech — Elon Musk being the prime example — are the new hypebeasts of the Internet age, with entire financial worlds like crypto spinning at their fingertips. Their perception of risk, by virtue of their wealth, is very different from the average person’s. Yet, by downplaying the costs of risk and inflating the rewards of crypto, a few powerful individuals create a bubble that is always precarious, set to burst at any minute.

Rohitha Naraharisetty is a Senior Associate Editor at The Swaddle. She writes about the intersection of gender, caste, social movements, and pop culture. She can be found on Instagram at @rohitha_97 or on Twitter at @romimacaronii.

Related

Activists Call On Zoom to Halt ‘Emotion Detection’ AI Tool